An invoice is also evidence that the business has provided the requested services/goods to the client. This is how businesses get payments, keep proper records, and meet their accounting and taxation requirements. It contains an itemized list of these services/products along with their pricing, rates, amount owed, and other relevant information.

Service and goods providers are required to register an account for VAT on sales, purchases above specified limits, and production of taxable items if they earn more than £85,000 per year.Īn invoice is a document which a business uses to request payment from its clients for the provided services or products. Who it’s for: Businesses and solopreneurs (domestic or foreign) selling all kinds of services or goods to the UK customers that qualify for charging and reporting VAT.

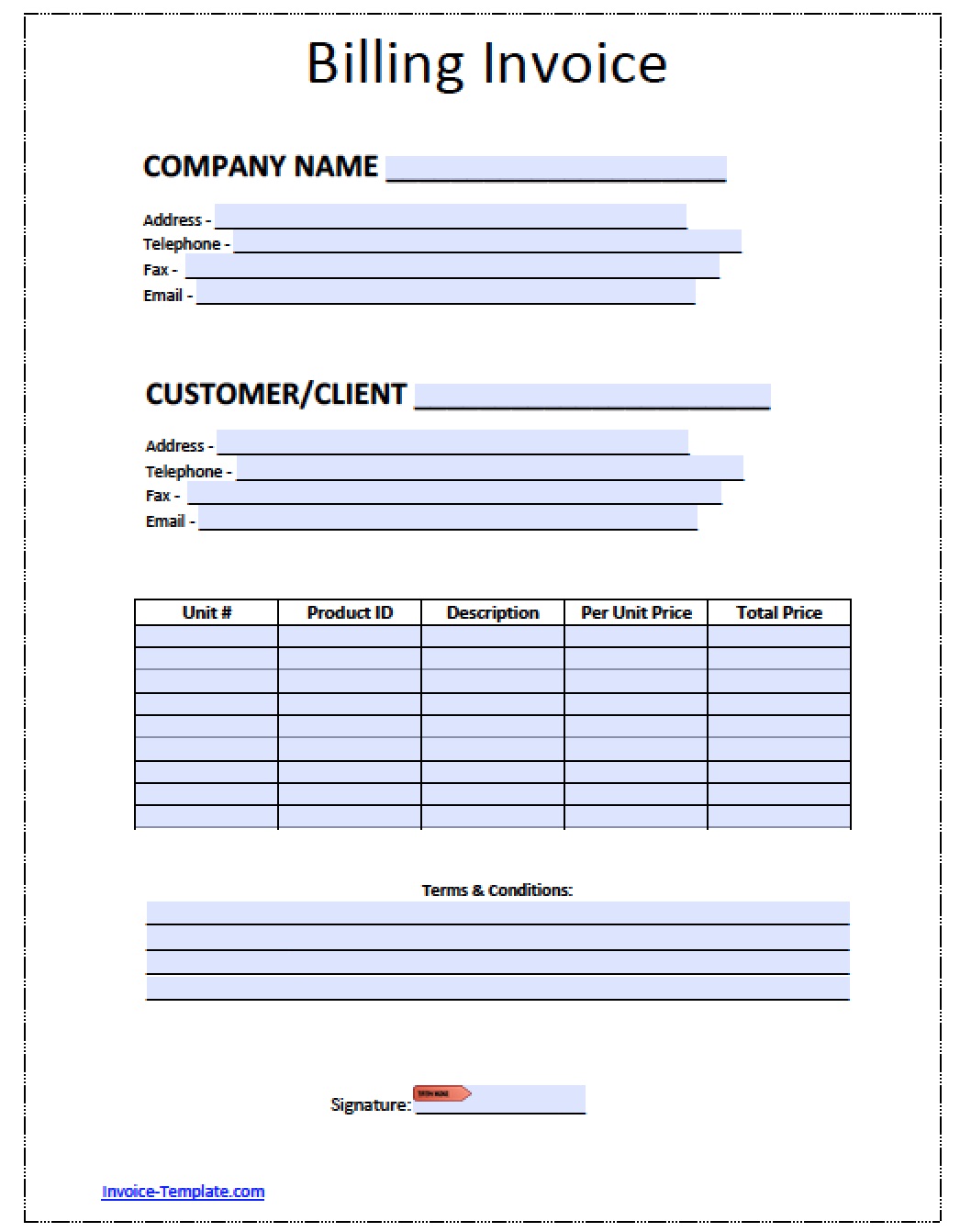

In addition to featuring spaces for the VAT rates and amounts, as well as the supplier’s VAT registration number, our template allows you to input full contact details of both you and your client, invoice number and date, the list of items along with their description, prices, and additional notes.

Some items are subject to 0% VAT but they still need to be reported as they’re not the same as VAT-exempt items. What it’s for: This invoice template is relevant for the area of the UK and it takes into account VAT (Value Added Tax), which is calculated as 20% of the cost for the provided services or goods, or 5% if these are reduced-rate goods or services.

0 kommentar(er)

0 kommentar(er)